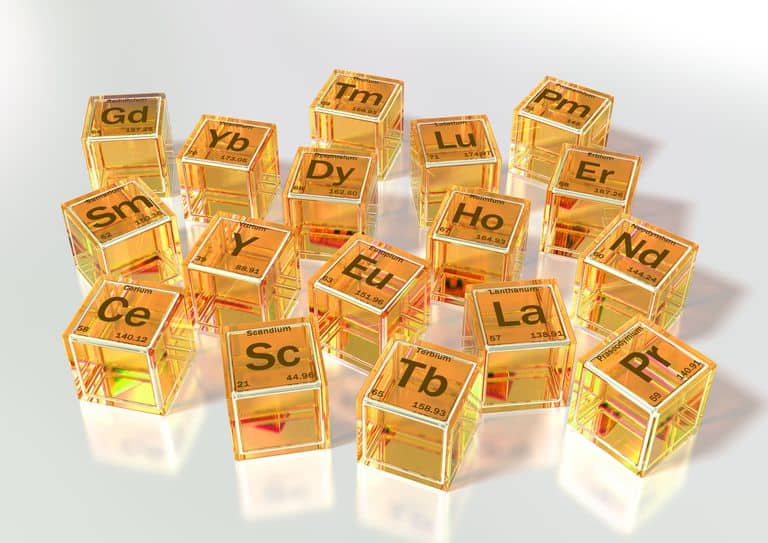

Rare Earths aren’t some fantastical territory straight out of science fiction, they’re actually not that rare either. This is the name given to 17 chemical elements, including scandium, europium or thulium, which are found on Earth in the form of minerals such as oxides and hydroxides. Some of these elements are very abundant, and others less so, such as thulium (even so, it is more abundant than gold and platinum).

The world’s largest producer of these elements is China, which currently produces 90% of world consumption. Today these elements are essential for the information economy, defense and green energy.

¿What are the rare lands?

In order to know what we are really talking about, and for some readers of this article, they may have never heard of the term “rare earths”, it is convenient to briefly review the minerals we are talking about.

Rare earths are not really “earths”, but rather a very diverse group of chemical elements, and they are not all that rare on Earth either. The name of earths is inherited, because in the history of chemistry, oxides were called earths, so I am going to tell you a little about these “scarce elements” and what role they play in our daily lives and why they have been converted to critical minerals.

These rare elements appear in the form of oxides, have magnetic properties (among others), and are largely the lanthanide family (not all), which appear in a breakdown at the bottom of the periodic table that we all know.

On the one hand, there are scandium and yttrium (they are not lanthanides), and then the 15 elements of the lanthanide group, which are lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium and lutetium. Two of these elements are experiencing the greatest boom to date: neodymium and praseodymium (Nd-Pr).

“Neodymium and Praseodymium (used in magnets) are the most valuable”, UBS Bank

What are these rare earths used for?

The minerals in question are key compounds for the development of electric motors, wind turbines, smartphones, energy-saving lamps, fiber optics, and microchip manufacturing; in addition to alloys for batteries in general, magnets, and night vision devices.

Many of these elements are integrated into the technologies that today are found in a myriad of industrial applications. Thus samarium is used in powerful permanent magnets that allow the development of modern electric motors. The storage of computer data, which is increasingly done in smaller equipment and with greater capacity, owes part of its advances to the extraordinary magnetic properties of ytterbium and terbium. The fantastic colors of the flat screens that have replaced the old cathode ray tubes of televisions have a lot to do with europium and yttrium. Cerium and erbium are key elements in special metal alloys and the latest advances in laser crystals are neodymium and holmium. Neodymium is also used as a colorant in ceramic glazes and glass of various types and in the manufacture of goggles worn by welders, since it absorbs the amber light of the electric arc flame. This element allows the crystals to develop delicate colors that vary from pure violet to light gray. They are also used by astronomers to calibrate devices called spectrometers and infrared radiation filters. Finally, neodymium is used in permanent magnets of the Nd2Fe14B type, with a high field intensity. These magnets are cheaper and more powerful and are common in products such as headphones, speakers, computer hard drives, sensors, etc.

These types of minerals have become the economic transformation in which the world has been immersed since the outbreak of the COVID-19 pandemic and which, according to the latest data available on the market, have doubled their price in just one year. A fact that must be highlighted because it is the beginning of the entire trade dispute between two powers the size of China and the United States.

Why are they “rare”?

Because despite the fact that they are quite common in nature, they are “rare” because they are not found in high concentrations or in a pure state on the planet, they are part of oxides or silicates which, ultimately, complicates their extraction.

And what is the problem with all this? Well, as on many occasions, the Earth is not capable of naturally producing everything that human beings need. To meet the current demand for rare earths, just for electric vehicles, five times more of these materials are needed. So says a report by the UBS Bank of Switzerland, published just a few days ago.

The UBS Bank report indicates that the demand for these materials will shoot up 300% by 2030 as a result of the increase in human needs and that they are considered “sustainable”.

The economic potential of the countries that produce this type of mineral

China currently produces 90% of the world’s supply of rare earths (prior to 1990, the US dominated production), while Australia’s Lynas and American MP Materials each produce another 10%. However, the UBS Bank assures that the treatment of these minerals is expensive and very polluting, which is why developed countries are not usually willing to carry out this function.

For now, neodymium and praseodymium (Nd-Pr) prices have doubled since mid-2020 mainly driven by supply caps and some rebound in demand. “We forecast that the price of Nd-Pr will go from 60 dollars per kilo to 100 dollars per kilo in 2024,” says the UBS Bank of Switzerland in its report.

Recently, the Financial Times newspaper has pointed out that China could limit the supply of these minerals to companies in Europe and the United States, which can generate significant bottlenecks in the production chains of many goods, but especially those related to the procurement of of a more sustainable world.

“We estimate that the demand for these minerals will skyrocket by 300% in 2030”, UBS Bank

The Rare Earth War

As I have pointed out previously, in this article; In 1990, the United States dominated the production of this type of mineral in California, Mountain Pass, but they had closed due to environmental sustainability issues, and now they are trying to reopen them with incentives and aid.

Now; Germany has just signed an agreement with Kazakhstan giving German companies the right to prospect for and mine Rare Earths in the former Soviet republic. In return, Germany will share its advanced technology with Kazakhstan.

In this way, Germany ensures access to Rare Earths and their supply to manufacture mobile phones, solar panels, batteries, etc. without having to rely on China. Pro-human rights organizations have also entered fully into this new War for Rare Earths, warning against non-compliance with these by the Kazakhstani regime.

On the other hand; Germany signed a similar agreement with Mongolia, which maintains substantial stocks of this type of mineral, which places it in a prominent position for economic and technological development in the coming years.

In Africa, some deposits of this type of mineral have also been detected, as well as in the Congo, Rwanda and in Latin America in countries such as Brazil and Chile. On the other hand, in countries like Russia, Australia, Spain and India there are reserves.

For example; The commercial deposits of these minerals are fundamentally associated with four types of minerals:

- Carbonatites, which are igneous rocks with a carbonate content of more than 50%, such as the Bayan Obo deposits in Mongolia and Mountain Pass in the United States.

- Alkaline igneous rocks, such as the Lovozero Nepheline syenite deposit in Russia

- The lateritic clays, result of the in situ alteration of the previous deposits. More than 250 deposits of this type are exploited in southeast China.

- The deposits of the monazitas of Matamulas in Spain.

The world production of rare earth oxides (REO in its English acronym) is of the order of 160,000 tons per year, of which 90% come from China and the reserves are sufficient to cover the demand for the next 625 years.

In the coming years we will be seeing how the market moves and what decisions will be made by the countries in need of this type of raw material for the manufacture of products for the world, since as we have emphasized it is China who has the floor.

DO YOU WANT TO LEAVE A COMMENT?