I share the history of Israel, as the second most important ecosystem in the world outside the US, and a great example to follow for Latin America.

StartUp Nation: The story of Israel’s Economic Miracle (Nation of entrepreneurs: The history of the miracle of Israel’s economy) is a book about innovation and entrepreneurial spirit and how a small country has achieved technological development from entrepreneurship.

The authors Dan Senor, prominent businessman in the Middle East and investor of numerous Israeli startups, and Saul Singer, editorial editor of the newspaper The Jerusalem Post and with 10 years of experience as an advisor on Foreign Affairs and Finance in the United States Congress, They examine the trajectory of several companies, to try to understand where all the creative energy that exists in Israel and how it is expressed comes from.

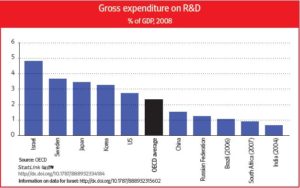

Israel is a country of only 8.7 million people in constant state of war since its founding in 1948, but it has a very high percentage of engineers and the world’s highest expenditure on research and development.

It is said that there is a “unique combination of audacity, creativity and dynamism”. This is, in part, what can explain that country has the highest rate of newly created companies in the world: a total of 4,500 or one for every 1,933 inhabitants, which is proud to have 107 companies listed in the NASDAQ technology index (more than all Europe together) and that 75% of its exports are high technology. But it was not always like that … in fact 30 years ago Israel based its economy mainly on the export of oranges.

The question is how it got there. The answer begins with a simple explanation from which everything else starts: “Adversity, like necessity, fuels ingenuity”, the authors say.

A lot has been written about Silicon Valley, in San Francisco, CA: about its multimillion-dollar startup appraisals, about its investment community or about the conditions that were given for its birth … and rightly so, it is the world’s number 1 ecosystem in terms of refers to entrepreneurship … but we have much more in common with the second ecosystem: Israel

And it is that few people know that the second most enterprising ecosystem in the world is much closer to us, both in distance and in culture: it is Israel, the great unknown. If we dare to investigate beyond the stereotyped image transmitted to us by the mass media, we discover a country full of nuances, but above all we discover the country now called Startup Nation.

A transformation based on talent and pride

And this miraculous transformation that has given birth to what is now called Silicon Wadi is one of the best and most interesting lessons we must learn in Latin America, as surprising as it may seem at first sight, it is a country that has many more coincidences with us … and therefore a better example to be inspired.

It is important to delve into the reason for this success, without a doubt, but understanding that there are some environmental factors that are difficult to imitate … like its geostrategic situation. Thirty years ago, the government of Israel seriously considered how they could achieve this famous change of productive model, and they started from the following reflection:

“We do not have a local / national market of sufficient size, and we do not have an accessible regional market (that is, its bordering countries) … so our only option is to work on a global scale. And for that we must build on our assets: we do not have a land rich in natural resources, we only have desert and people … so we must build an economy based on talent “

And to understand this statement it is important to understand a little more the character and culture of the Israeli people: open and direct, obsessed by the background and not by the form, and tremendously argumentative (in fact there is a saying that says “two Jews, three opinions “That reflects it very well). It is a tremendously diverse people in terms of nationalities of origin, languages, ethnicities and even languages (although practically all speak correct English, in addition to their mother tongue and Hebrew) … and where the only thing that unites them is their religion.

And this is one of the possibly most controversial factors but that is undoubtedly part of the success of this Startup Nation: unlike Costa Rica, a country in which we do not stop questioning our own value and where there is a certain inferiority complex with other countries, in Israel they feel the chosen people. And that is something that permeates all layers of society and gives confidence in the future that many other countries lack. In fact it does not matter who you talk to, from the public or private world, first you will proudly tell how great the country is and the tremendous capabilities you have, and then you will talk about your company.

The importance of education and the influence of military service

With this eagerness to transform your economy one of the key factors on which you worked is university education … and for the results we could say that with great success: Israel has 2 universities among the 30 best in the world, and according to the WEF global competitiveness report has a ratio of 249.2 patents per capita (for example in Spain this ratio is 9.1).

But if there is something that marks the Israeli education is the training received during military service (36 months for men and 21 for women). Beyond the purely military training, their education goes in parallel with multiple subjects not directly military and with an amazing training in skills: creativity and capacity to make decisions for oneself are greatly enhanced (as opposed to the traditional vision of the army , there where he follows decisions without thinking is called roshkatan – small head).

In fact, many of Israel’s most well-known startups were born from specialized engineering units, such as the famous 8200, and it is common in job interviews to assess the applicant’s education not only for formal education but for the unit in which he served during the militia period.

After the time of militia, it is usual for young people to take a trip to get to know the world, and when they return, they begin university education … with a high level of maturity and personal experiences behind them. And when finishing (or during) their university period many of these guys decide to found their own startup instead of working for a third party (much more attractive, since everyone knows someone who has had great success or has sold their startup).

The crucial role of the government

And these new companies can choose to participate in the government’s incubator program, one of the most interesting in the world. The program was born in response to the wave of qualified immigration suffered by Israel in the 1990s (more than 750,000 Russian refugees). It was then considered that the best way to integrate this population was not to make them do low-skilled jobs but to offer them the possibility of setting up their own company and take advantage of their talent … with great success.

Any new company accepted in any of the more than 30 incubators in the country is provided not only support, advice and a place to work but $ 250,000 USD … in exchange for royalties on the products produced by the company. This win-win philosophy of public money in exchange for royalties permeates all programs to boost innovation and allows the government to cover an important part of its budgets from one year to the next.

The emergence of the Israeli Capital Venture

But of course, the companies created were then faced with a problem: the lack of funds to grow … since the venture capital market in Israel was small and little experienced (something similar to what happens in the Region with some exceptions). With the vocation of solving this problem the government created a program that in my opinion was the spark that “started” the entrepreneurial ecosystem of the country: Yozma.

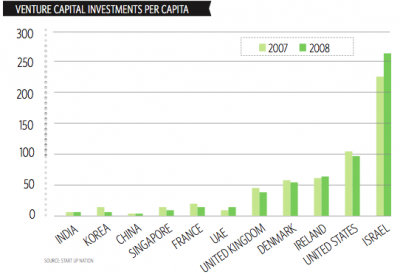

Latin America can be transformed into an innovative and developed region, drawing on the lessons of other countries. International experience shows that venture capital has a fundamental role when translating ideas and products into large companies. Israel is a global star of innovation.

The Yozma Program was the most ingenious and successful Israeli government policy in the field of innovation and entrepreneurship, generating tens of billions of dollars of value at no cost to the public. Launched in 1992, it is widely recognized as the catalyst for the local entrepreneurial capital industry and the startup ecosystem.

The government was desperately seeking to create jobs for more than 800,000 immigrants who had arrived in the country after the fall of the Berlin Wall, many of whom were scientists and engineers. The first step was to create in 1991 some 24 incubators that provided capital, infrastructure and managerial support for the development of innovative technological products. It was also thought of a way to support new companies to travel through the valley of death, which is the period from the first injection of funds until it starts generating own funds with sale. That is why the Inbal Program was created in 1991, an insurance that tried to stimulate the creation of venture capital funds with a guarantee of 70% for the capitalists listed on the Israel Stock Exchange, but the program failed to achieve traction. , largely due to the challenges of lack of liquidity of the assets that were sought to be financed.

The Israeli government noted that companies that had developed innovative solutions had enormous difficulties translating a great product into a large company. They went out to investigate how other entrepreneurial capital ecosystems worked and perceived that entrepreneurial capital funds contributed more than capital: they also brought value to the table with their networks of international contacts and their knowledge of how to scale up companies globally. It was also concluded that Israel should play with the international rules of the game to be successful and that the State should limit itself to creating the right incentives without getting involved in the choice, supervision and management of the startups.

That is why he conceived a program based on “matching funds” to attract international and local players that over time would form the backbone of the investment ecosystem. The Yozma Program was established with an initial investment of $ 100 million (USD), which was recovered in a few years. The government invested $ 80 million (USD) in 10 funds that would have private partners and invested another $ 20 million (USD) of US dollars directly in startups through its own fund.

The funds with participation of the private sector were the centerpiece and most successful of the program. Each of the 10 funds was constituted as a new limited liability company with 40% of public capital and 60% of private capital. The private sector partners were chosen by competition and had to present two members: an international entrepreneurial capital fund (providing expertise and global networks) and a well-established local financial company (which would allow the development of a local industry). As private partners had 60% of the capital, they had the incentives to efficiently apply capital and the autonomy to run the fund without government intervention.

Sensing that attracting the best funds in the world would not be trivial and that there was a perception of risk greater than the real one, the Israeli government had the genius to create incentives that multiplied the potential for creating value while reducing the risk of private partners. without harming the taxpayers. They did this by giving private shareholders the option to buy the government’s share after a couple of years by paying the principal plus an interest rate. In this way, if the fund fails, everyone will lose proportionally and if the fund is successful private actions could increase their profits while the government will recover its contribution, earn interest and create an industry with a gigantic potential for job creation and taxes.

In this sense, Israel has become the first country in the world with a higher per capita risk capital investment ratio: between $ 150 and $ 170 dollars.

The world’s leading technology companies such as Intel, IBM, Cisco Systems, SAP, Philips, Hewlett-Packard, AOL, Microsoft, Motorola, and Computer Associates, as well as many Israeli high-tech companies that have their headquarters in the region, such as Zoran Corporation, CEVA Inc, Aladdin Knowledge Systems, NICE Systems, Horizon Semiconductors, Radware, RADWIN, Tadiran Telecom, Radvision, Check Point Software Technologies, Amdocs, Babylon Ltd., Elbit, Israel Aircraft Industries decided to set up R & D centers in Israel to take advantage of the enormous talent that they had been able to observe, and that added the partners of the corporate world that the country needed to establish alliances and marketing channels … as well as possible scenarios for buying their startups.

In short, we find a country that is the second most powerful entrepreneur ecosystem in the world … but remember that it was not always the case. It is an example of how a country can reinvent itself, but building from the bottom up (the needs of the people and their main actors and not from the “vision” of a politician), making the need virtue and all, believing in their own abilities.

Dan Senor (author of the book) mentions how what for many countries represents an exception, in Israel is the norm: “Entrepreneurship has become a professional option like any other, Israelis are aware that it is OK to try something and fail. Obviously, getting it is better, but failure is not a stigma, it’s an experience to add to the CV”.

Yigal Erlich (the promoter of Yozma and the one who is considered the father of venture capital in Israel) about the situation of the entrepreneurial ecosystem in Latin America says the following: You just have to listen to the entrepreneurs, believe they can achieve it … and give them the necessary time.

WHAT DO YOU THINK?